Introduction

1. Product Overview:

Algo Trading System is a product that supports multi-platform trading. Its core value lies in solving the various pain points that users encounter in the process of trading with exchanges. We abstract and encapsulate the core links in the transaction process, which greatly reduces the learning cost of users. Through RPC, users can easily connect with existing products. At the same time, the Alog Trading System also retains the low latency, high security and easy deployment features of the previous system. Fully meet the basic needs of digital currency traders.

2. Applicable customers:

- Junior users who have just started to enter the digital currency field

- CCXT users

- Users with their own quantitative products

3. System composition:

Our set of products mainly includes 3 aspects:

1. Market Engine

Market Engine is responsible for receiving the market dynamics of exchanges. Includes: Book and Trade data. At the same time, Market Engine broadcasts these data in the local area network by means of Multiple Cast.

2. Trade Engine

Trade Engine is mainly responsible for completing various operations of orders, including: placing an order, canceling an order, and receiving an order receipt. At the same time, it can also receive real-time change data of Account's Balance and Position.

3. Client API interfaces

We provide two API interfaces: python and C++, which is convenient for users Connect with our products. For details, please refer to the API documentation. There is also a complete open source code reference.

4. Deployment methods

We provide three deployment methods:

-

Cloud deployment customers do not need any operation, just need to pass Python or C++ API can be directly connected to the server we have deployed in the cloud, which is convenient for users to test the experience.

-

Local Docker deployment method Downloading and running our Image through Docker can directly run all the systems required for the transaction. For details, see Quick User Guide

-

For local deployment, you need to download and decompress our Package to run locally. The required local operating system must be Ubuntu 20.04 version. At the same time, a series of installation and configuration work is required. Higher requirements for users.

5. Process management

Algo Trading System includes three processes:

- ccc_trade_service: service class, used to manage ccc_trade_instance and ccc_market_instance instance classes.

- ccc_trade_instance: responsible for transaction instance class

- ccc_market_instance: responsible for Instance class of market data.

We provide two ways to manage processes for different types of processes:

-

The local management method is mainly for the ccc_trade_service process running on Docker or the local machine. The improved process needs to be managed through the command line: -- Start: ccc_trade_service ./service_cfg.json -- Shut down: pkill -f ccc_trade_service

-

The API management method is for the processes of two instance types, ccc_trade_instance and ccc_market_instance. The corresponding management functions are provided in the API. For details, please refer to the corresponding API documentation: Python: C++

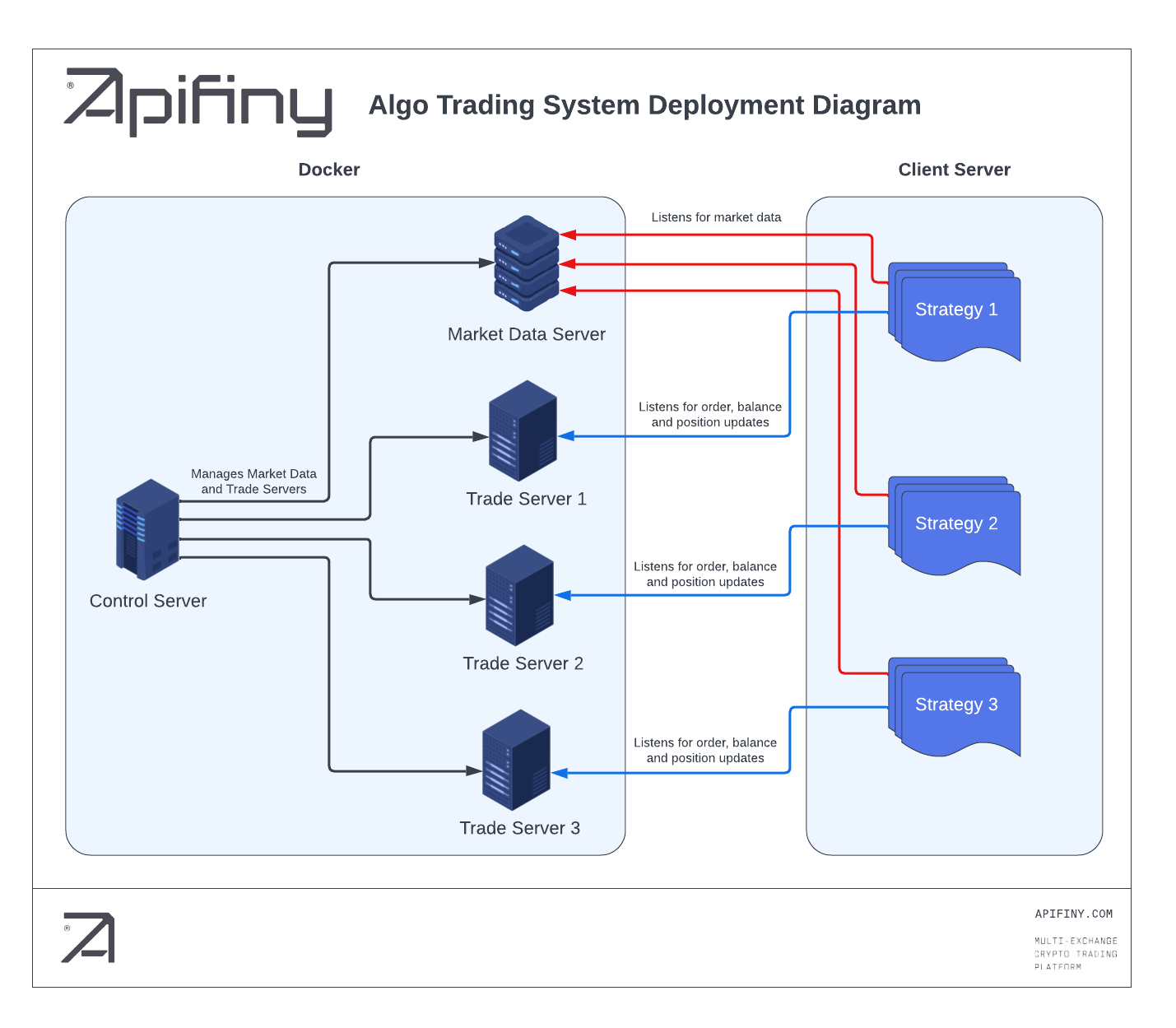

The Algo Trading System deployment diagram is as follows:

6. Supported trading platforms

* 7. TestNet*

Currently we support Binance Spot's TestNet. It is convenient for users to conduct system and strategy testing. - Binance Spot TestNet Account Application